Zuzana Kalincová | 9.4.2024

DAC 6 as an unlawful invasion of privacy? Opinion of the Advocate-GeneralTaxes, accounting, law and more. All the key news for your business.

Roman Burnus | September 27, 2022

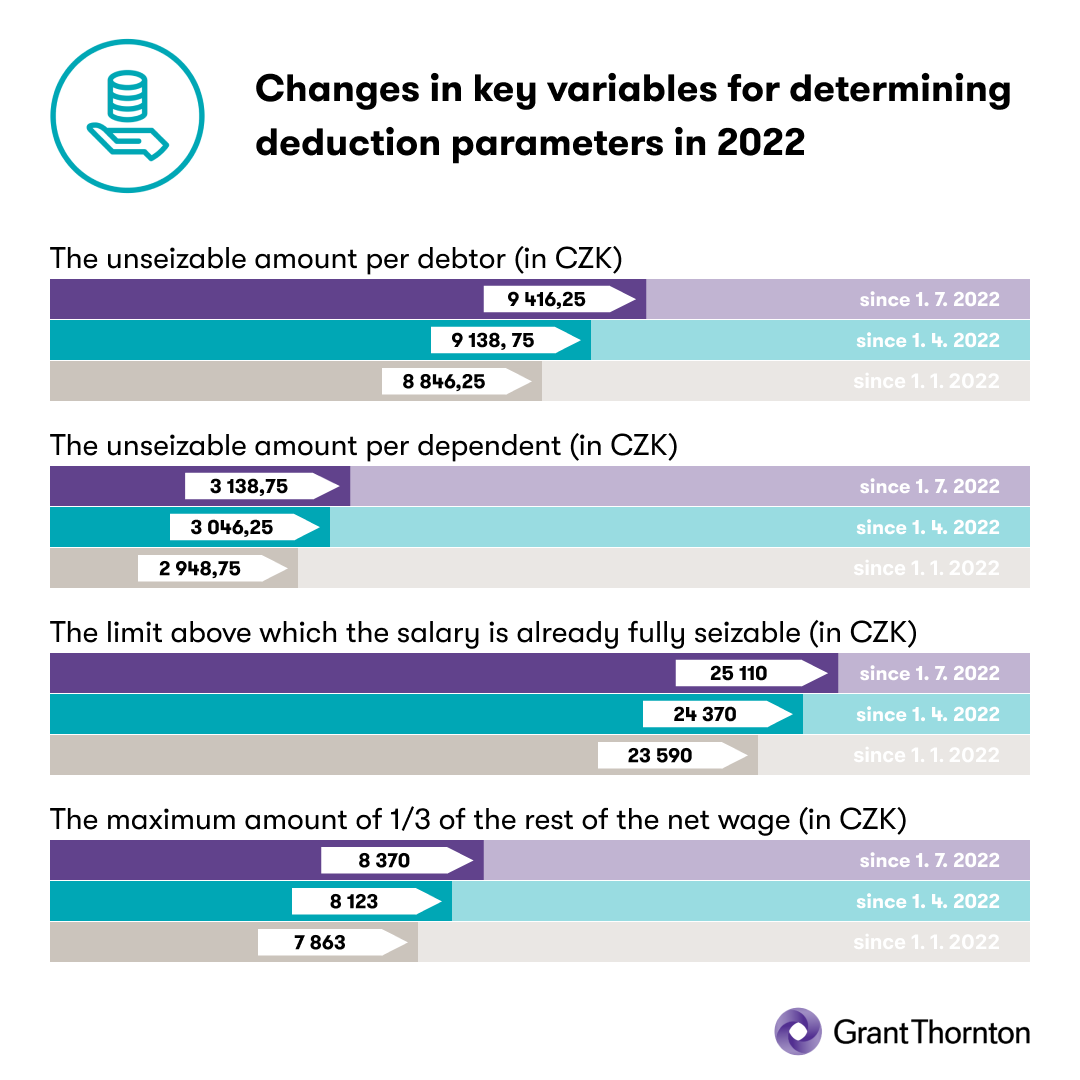

Due to rising inflation and the subsequent increase in prices, the non-deductible amounts, the unseizable minimum and other parameters of enforcement deductions from wages have been valorised for the 1st and 2nd quarters as well as for the 3rd quarter of the year.

The limits on enforcement deductions from wages are based on:

Depending on points (a) and (b), the amount of the unseizable sums, i.e. the sums, which must in any event remain with the debtor, is determined. In addition, the amount of each third of the net wages is calculated after deduction of the unseizable amounts determining how much may be deducted for priority and how much for non-priority claims, or how much must remain for the obligor, as well as the amount, above which the deductions are to be made without limitation;

The employer shall apply the newly calculated unseizable amounts and other parameters for the first time for the pay period, in which the date, from which the amounts change, falls. Thus, the last increase on July 1, 2022 will only affect wages paid in August.

Author: Roman Burnus, Valérie Kovářová