Taxes, accounting, law and more. All the key news for your business.

Daniela Riegel | October 11, 2017

Photovoltaic power plants belong among alternative sources of electricity production, because these power plants use solar radiation to produce electricity. This article focuses on the development of their taxation and depreciation of tangible assets of photovoltaic power plants (hereinafter “PVP”).

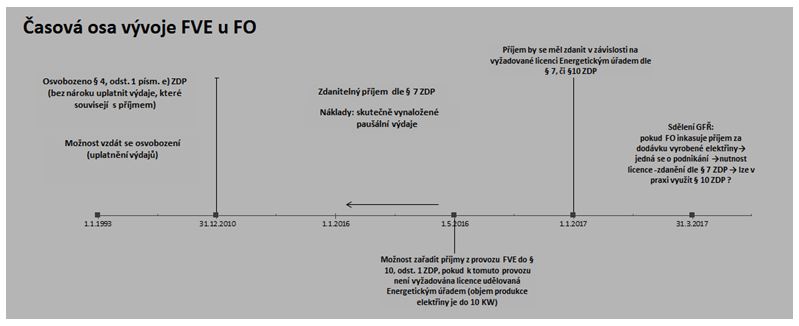

Until the end of the year 2010, act no. 586/1992 Sb., on income taxes (hereinafter the “ITA”) enabled exemption of the income from operation of solar systems among others. Taxpayers had the option of decided whether or not to apply the option of exempting income from the operation of PVP. This income was exempted in the calendar year, in which the system was launched, and then for five immediately subsequent years. In case the taxpayer decided to apply exemption according to article 4 paragraph 1 letter e) of ITA, the taxpayer then did not have the option of applying the expenditure (article 25 paragraph 1 letter i) of ITA), which related to income from the operation of of PVP.

The taxpayer could, of course, also choose the other option, that is not to apply exemption of the income from operation of PVP. In such a case, he gave up the exemption by announcing this fact to the tax administrator. If the taxpayer chose this option, he gained a right to apply the costs, which were related to income from the operation of PVP.

Since January 1, 2011, this exemption has been cancelled. The year 2010 was the last year, in which there was the option of applying exemption. In this case, exemption could no longer be applied by entities, which launched an alternative source of electricity production before the year 2011, that is before this amendment took effect, either.

Since 2011, the income from PVP operation is subject to corporate and personal income tax. For legal entities it represents taxable revenue. In the case of natural persons, this income is taxed according to article 7 paragraph 1 letter c) of the ITA as income from other enterprising. This income can be lowered, either by:

If the annual income from the operation of PVP is lower than CZK 6,000 and the taxpayer only has income from employment at the same time, then, if the taxpayer does not submit tax return, such income will not be subject to taxation.

On January 1, 2016, the “energy” act (act no. 458/2000 Sb.) changed, where, among other things, article 3 paragraph 3 was also changed, which newly stipulated that persons can enterprise in energy branches in the Czech Republic under set conditions only on the basis of a licence awarded by the Energy Regulation Office. This article further says that the licence is required for electricity production in PVPs with installed output of more than 10 kW, which is intended for the customer's own consumption and it is not an insular system, or such a PVP has installed output of up to 10 kW, included, but another PVP of a licence holder is connected in the same delivery point.

The lawgivers reacted to the change of the energy act with a change of the income tax act, more specifically article 10 paragraph 1 letter a) of the ITA, where it was newly said that other income also includes income from the operation of plants for electricity production, for which a licence awarded by the Energy Regulation Office is not required. Thanks to the temporary stipulation, taxpayers, to whom this stipulation applied, had the option of deciding, whether to follow the new stipulation and tax income from the operation of PVP according to article 10 of ITA (and possibly apply exemption of income, which will not exceed CZK 30,000 per year) for the year 2016 already, or whether they will tax them according to article 7 of ITA. It was further expected that from the year 2017, new rules will be followed, and this in case a taxpayer will have income from the operation of a PVP, for which no licence is required, he will tax the income as other income, according to article 10 of ITA. This procedure has one other advantage, which is that other income according to article 10 of ITA is not subject to social and health insurance contributions.

In the year 2017, no amendment occurred relating to the income from operating a PVP system, but despite this fact, an Announcement of the General Financial Directorate (hereinafter “GFD”) was published on the website of the financial administration. In this case, GFD is of the opinion that for the option of using taxation of income from the operation of PVP according to article 10 of ITA, installed output is not the only criterion, but the fact of whether or not operation of electricity production is a business, is also an important parameter. In case electricity production is operated as business, a licence is necessary, regardless of installed output being under or above 10 kW. GFD is of the opinion that if a natural person operated electricity production and supplies electricity thus produced to the power grid, receiving income for this electricity, this represents business according to the energy act and such income is thus taxed according to article 7 of ITA.

GFD is, on the other hand, of the opinion that a licence from the ERO is not necessary, if the taxpayer uses a PVP with output up to 10 kW and uses this electricity for his own consumption within an insular system.

Based on the above, the absurd situation occurs that according to the statement of GFD it is not possible to apply article 10 paragraph 1 letter a) of ITA in practice at all, because in case a taxpayer receives remuneration for supplying electricity produced by a PVP system, he automatically falls into the category of article 7 of ITA, and in case he only uses electricity for his own consumption, he practically does not generate taxable income.

Timeline of development of PVP in case of natural persons

Tax depreciation

The form of tax depreciation of PVP has also undergone historical development, although not as turbulent as the taxation of income from PVP. If the taxpayer applied exemption, he did not have the option of applying depreciation of the equipment for electricity production from solar radiation as a cost, but after the end of application of exemption, the taxpayer could begin tax depreciation, from the original price of the equipment. In case the taxpayer did not apply the option of exemption, he could depreciate from the inclusion of this asset into use. In any case, in terms the time of depreciation of the system, the taxpayer could decide between even or accelerated depreciation with the option of not beginning or of interrupting the given depreciation.

From November 1, 2011 a new article 30b of ITA was included in the income tax act, which governs depreciation of tangible assets that are used for production of electricity from solar radiation. It is stated here that a PVP equipment, which is classified as CZ-CPA production marked with the code of group 27.11, 27.12 and further in the category of CZ-CPA 26.11.22 is depreciated evenly without interruption for a period of 240 months up to 100% of the initial price. These depreciations are set as entire months, and a duty arises for the taxpayer to start depreciation in the month following after the month, in which the conditions for depreciation were fulfilled.

Technical improvement of the given asset is governed by article 30b paragraph 3 of ITA. In this case, the taxpayer continues to depreciate tangible assets from the raised initial price, which is already lowered by the applied depreciations. Depreciation from the raised initial price is applied by the taxpayer from the month following the month, in which technical improvement was completed. Depreciation must take place without interruption, for the remaining period, but for the period of 120 months at minimum.

From the year 2011, several basic situations could take place, as follows:

In the near future, no changes in the above-mentioned areas are being planned yet. We will thus have to wait and see, if the lawgiver changes the act and if there will be no space any more for the above-mentioned absurd interpretation for the taxation of income from PVP for natural persons. In case this topic has caught your interest, we are available for possible consultations.