Zuzana Kalincová | 9.4.2024

DAC 6 as an unlawful invasion of privacy? Opinion of the Advocate-GeneralTaxes, accounting, law and more. All the key news for your business.

| March 18, 2020

With regard to the approaching deadline for submitting the personal and corporate income tax declarations and solution of the current situation relating to the coronavirus, we would like to inform you with this article about the obligations arising for taxpayers based on the Income Tax Act in the context of the measures adopted on 16 March 2020 as a result of the declared state of emergency in the Czech Republic.

General rules

The deadline for submitting the personal and corporate income tax declaration for the year 2019 is set on 1 April 2020. If the tax declaration is processed based on a power of attorney for a tax consultant, or the taxpayer has a statutory obligation to have his financial statement audited, the deadline is prolonged by another 3 months, i.e. until 1 July 2020. Taxpayers are also legislatively enabled to use the option of submitting a Request for prolongation of the deadline for submitting the tax declaration, which needs to be duly justified, however.

If the tax declaration is not submitted within the regular deadline, the tax administrator will impose a fine for late tax statement (article 250 of the Tax Procedure Code). It is possible, nevertheless, to use a so-called protective period of up to 5 workdays after the specified deadline (no sanction is imposed in this situation).

In case a fine for late tax statement is imposed, it is not possible to request its waiver from the tax administrator.

The rules after state of emergency in CR

With regard to the current situation relating to the spreading of coronavirus, the deadline for submitting the income tax declarations is not prolonged (the original deadline applies both for the personal income tax and the corporate income tax). Nevertheless in case the tax declaration, which should have been submitted by 1 April 2020, is submitted by 1 July 2020 at the latest, no sanction will be imposed according to a decision of the Finance Ministry (see the Decision on waiver of tax accessories and administrative fee due to an emergency situation).

For completion, we add that the standard deadlines for returning overpayments when submitting an income tax declaration, from which a tax overpayment follows, should apply.

General rules

The deadline for paying tax relates to the specified deadline for submitting the tax declaration. This means that the tax must be paid on the date of the deadline for submitting the tax declaration at the latest (note: the finance must be credited to the bank account of the tax administrator on that day already).

For the payment of tax, too, the so-called protective period applies (5 workdays from the due date), when no sanction is imposed.

In case the above-mentioned conditions are not met, the tax administrator will prescribe late payment interest due to late payment (article 252 of the Tax Procedure Code).

If the taxpayer does not have the money to pay the tax obligation, he has a statutory option to file a request with the tax administrator for permitting instalments or postponement. In case of complications with fulfilment of the obligation of tax prepayments, taxpayers also have the option of requesting reduction or cancellation of tax prepayments. In this case, the tax administrator usually requires substantiating the current economic results or income.

Another operation for reducing the effects of late payment and prescribed late payment interests is to request their waiver. If justifiable reasons exist (see Directive D-21), the tax administrator may pardon late payment interests partially or completely. This also applies to late payment interests relating to postponed or instalment tax.

The rules after state of emergency in CR

In the current situation reacting to the danger in the form of coronavirus spreading, it is possible for taxpayers, based on a measure of the Financial Administration, to file a request for permission of instalments/postponement without needing to pay the administrative fee of CZK 400.

If the income tax underpayment is paid by 1 July 2020 at the latest, while the deadline for payment is set on 1 April 2020, the tax administrator will prescribe no late payment interest (according to the Decision on waiver of tax accessories and administrative fee due to an emergency situation).

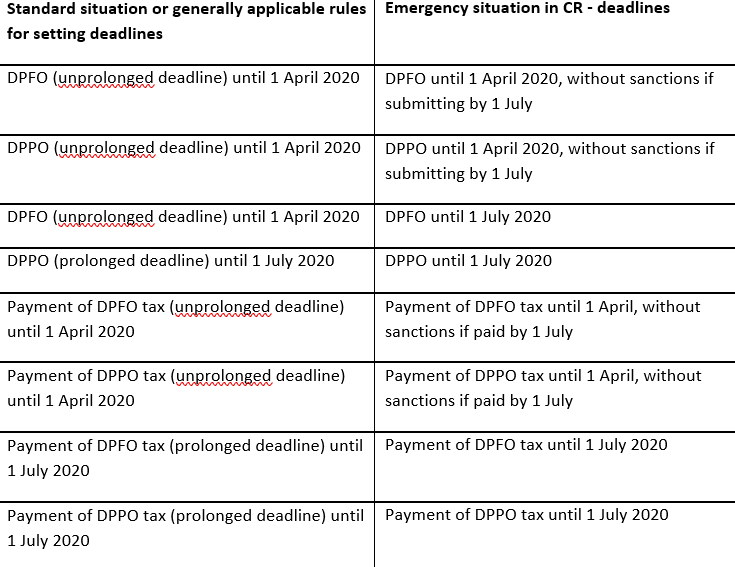

Overview table relating to tax obligations

*DPFO – personal income tax, DPPO – corporate income tax

Social insurance of self-employed persons (OSVČ)

General rules

A person, who performed a self-employed activity for at least a part of the calendar year, is obliged to submit a survey of income and expenses of self-employed persons to the respective social security administration. This survey must be submitted within one month from the deadline for submitting the tax declaration at the latest.

If the tax declaration is not prepared by a tax consultant for the self-employed person, the person is obliged to submit the survey for the year 2019 by 4 May 2020 at the latest. If a tax consultant is preparing the tax declaration for the self-employed person, the person is obliged to substantiate this fact to the social security administration by 30 April 2020. The person is then obliged to submit the survey for the year 2019 by 3 August 2020 at the latest.

The underpayment of insurance for the year 2019 that follows from the survey is due within 8 days after the overview has been submitted.

Health insurance of self-employed persons (OSVČ)

General rules

A self-employed person is obliged to present the survey to the respective health insurance company within one month from the deadline for submitting the tax declaration for the year 2019 at the latest, that is by 4 May 2020. The self-employed person is obliged to substantiate the fact that a tax consultant is preparing its tax declaration to the respective branch of the health insurance company by 30 April 2020. The person is then obliged to submit the survey for the year 2019 by 3 August 2020 at the latest.

The underpayment of insurance for the year 2019 that follows from the survey is due within 8 days after the overview has been submitted.

The rules after state of emergency in CR

No information has currently been published regarding any prolongation of the deadline for submitting Surveys for insurance premium, or waiver of sanctions for late submission, both in the case of the survey for social and for public heath insurance. At the moment, then, the above-mentioned general rules for submitting the Surveys apply. The general deadlines may thus cause problems in case of the set deadline for submitting the tax declaration within an unprolonged deadline, i.e. by 1 April 2020, which would need to already be processed for the purposes of the Survey.

We have information, however, that negotiations to resolve this discrepancy are currently in progress and we believe that submission of Surveys will be linked to the already published and approved relief for submitting the tax declaration. We will continue to monitor the situation regarding the obligation to submit the Surveys and will inform you about potential changes resulting from the declaration of a State of Emergency in the Czech Republic.

General rules

If you are a payer of the personal income tax and you received exempt income in the year 2019, which is higher than CZK 5 000 000, you are obliged to announce this to the tax administrator. This announcement needs to be submitted to the tax administrator within the deadline for submitting the tax declaration, which applies to you, in compliances with article 38v of the Income Tax Act. In this case, too, it is necessary to beware of sanctions, i.e. fines according to article 38w. There is a fine, the amount of which is firmly fixed, impending for failure to announce this income.

The rules after state of emergency in CR

With regard to the fact that the deadline for submitting the declaration has not been adjusted, the obligation remains to announce exempted income within the set deadline for submitting the tax declaration, i.e. by 1 April 2020 in case of the unprolonged deadline. In case of late submission, the Decision on waiver of tax accessories and administrative fee due to an emergency situation does not apply to the fine for failing to announce exempted income, because its legislation is not based on the Tax Procedure Code.

In case the rules for Announcing exempted income are amended or adjusted, we will inform you immediately.

To conclude, we would like to mention that the activity of tax consultants, accountants and auditors has not been limited in any way on the part of the government, and it is therefore possible to continue to turn to them. This has been confirmed by the Finance Ministry, too, which has issued Specifying communication for this, available at https://www.mfcr.cz/cs/aktualne/tiskove-zpravy/2020/upresnujici-sdeleni-mf-k-cinnosti-danovy-37852.

We believe that this article has helped you clarify certain inaccuracies you may hear or read from various media sources at present. In case of any questions, please, do not hesitate to contact us.

Jan Tahal

Marie Rudolfová