Taxes, accounting, law and more. All the key news for your business.

Ivan Fučík | September 25, 2017

During the last 2 years, the topic of orders to ensure tax has been frequently discussed by many, not only the experts. How justified is the use of this tool? Is there a possibility of excessive use of this institute by the Financial administration? These questions are being asked more and more often. In this article we will focus mainly on describing what an order to ensure tax is; we will also look into the current affairs connected to it. We believe this is important because misuse of the order can lead to tax subjects suffering fatal damage.

What has brought the discussion on?

It is important to note that the order to ensure tax means a serious encroachment into the assets of a tax subject and in many cases it can imperil a company’s existence. The media have recently reported on the Europrint company which has been forced into becoming insolvent by the processes of the Financial administration. The FA have allegedly imposed orders of distrainment on the Europrint company totalling CZK 386 million. There has been no effectual decision made so far and the FA refuses to disclose information about this case because of confidentiality. There have been quite a few similar reports about factual liquidation of healthy functioning companies, such as the Autotrans Petrol company, the LevnéElektro e-shop, ČDK Praha DIZ, VHS Ropa Plus, and the case of the FAU company, the most famous of all of these.

What is the order to ensure tax and when can it be used?

It is the § 167 section of the Tax Code that deals with orders to ensure tax. This order applies to tax which has not been ordained, or tax which has been ordained but its maturity has not passed yet. This section says that the administration can use the order to ensure tax when there is justified concern that it will not be possible to collect the tax when the time for the collection comes, or the collection will be accompanied by significant difficulties.

The order to ensure tax can be issued only if there is justified concern. Justified concern can arise for example if a tax subject repeatedly does not fulfill their tax duties within the time period given by the law, or if the economic and financial situation of the subject suggests that the future could bring certain complications. The fact that a tax subject does not have problems with fulfilling its tax-related obligations does not mean that an order to ensure tax cannot be issued for that subject. Martin Janeček, the director of the General Financial Directorate, said that “in theory, any company can be used as the missing trader”. According to this, no company can be absolutely sure that it hasn’t become a victim of someone else’s tax evasion plan and that an order of distrainment won’t be imposed on it, too.

Some readings say that the order to ensure tax is a decision of prestige which is often founded on mere hypotheses. That is made evident by the law since, as described above, it concerns ensuring of tax which might have not been assessed yet and the hypothetic ability to fulfill the obligations is sometimes difficult to asses by the company alone, let alone by the Financial administration.

Upon deciding whether or not an order to ensure tax should be imposed on a certain company one must consider § 5 paragraph 3 of the Tax Code which says that the financial administration shall use only such tools that burden the tax subject and third parties the least and at the same time enables the administration to reach its goal. However, orders to ensure tax mean a serious burden for tax subjects and that is why the order must include an explanation and detailed reasoning for its issuance. In other words, the notification must always include reasons for concern about delay. These reasons have not always been justified; let us mention the ruling of the Supreme administrative court Afs 335/2016 – 38. In this case, financial administration has doubted the possibility to collect tax for three reasons. The first reason was the assumption that the amount of tax that will be imposed on the plaintiff will be of more worth than the plaintiff’s assets. The second reason were the requirements of EU provisions on granting public aid (the defence itself has recognized this reason as not pertinent to the case). The third reason was the object of activity of the tax subject because the subject traded with fuel and that was labeled by the financial administration as a risk commodity. The first reason was turned down by the court saying that this argument is not sufficient for such a serious encroachment because the net worth of a subject cannot give evidence about the subject’s ability to pay. According to the court, the subject can for example ask for indulgence or for payment of tax in instalments. Furthermore, the court stated that one cannot eliminate the possibility of the company generating sufficient income to be able to pay the tax in due time. The third reason was also not seen as pertinent by the court because it did not take into consideration the tax subject’s past etc. Thus, for the above-mentioned reasons, the order to ensure tax has been revoked.

In practice the tax subject usually learns about the issuance of the order to ensure tax in the moment of its enforcement, meaning in the moment when its accounts are blocked and the distrainment process begins. The Tax Code § 167 paragraph 3 states a period of 3 working days, however, if there is a risk of delay the order to ensure tax becomes enforceable in the moment the tax subject is informed. In Act no.235/2004 on value added tax, section § 103 it stands that the order to ensure tax is in force and enforceable from the moment of its issuance if there is a risk of delay. In this case the order becomes enforceable the moment the tax subject is informed which is followed by an immediate economic collapse of the subject.

The seriousness and fatal consequences of using the order to ensure tax has been confirmed by the Supreme Administrative Court which – besides the 9 Afs. 13/2008-9 ruling – said that this is a very serious encroachment into the rights and standing of tax subjects and that it can seriously endanger their economic activity (and thus existence itself). In this ruling the SAC observed that according to the law the financial administration is not given any limits or restrictions for issuance of an order to ensure tax and the tax subject is obliged to make sure the tax is paid. According to the court there is a great disproportion in this relationship.

The analysis and new methodology for using orders to ensure tax from the Financial administration

The Financial administration have promised a fix in the shape of new methodology of the order. It lies in the fact that prior to tax distrainment the subject will be explained additional possibilities to fulfill the tax obligation (such as third-party liability or financial guarantee).

By analyzing court proceedings the Financial administration reached the conclusion that in some cases the administration has been reproached for insufficient (and thus illegal) justification of the adequacy of a future tax assessment. The order to ensure tax must among other things include the amount of tax and this amount must be justified at the same level as the order itself. The Financial administration should even in this case apply the principle of adequacy and after diligent consideration should consider the extent to which the order to ensure tax should be used in each case.

What is excessive use of orders to ensure tax?

Lately there have been critical voices saying that the order to ensure tax is used excessively and leads to liquidation of companies. The Financial administration refuses these claims and says it believes the use of the orders is not excessive. In an interview for Hospodářské noviny, Martin Janeček said that “the order to ensure tax is a unique tool that is being used as a last resort to ensure payment of tax in exceptional and exceptionally serious cases”. This view has also been communicated in the Analysis of Orders to Ensure Tax issued by the Financial administration of the Czech Republic. Here, the FA claims that it concerns only a small group of tax-payers whose amount is somewhere between 0,04 % and 0,084%. Furthermore, the FA defends its procedures saying that almost two thirds of the affected subjects have not submitted an appellate brief. On September 6th, 2017 Anna Šabatová, an ombudswoman, issued a press statement in which she says that she has been carefully watching the allegedly illegal proceedings of the Financial administration and that she has not found proof of the risk of excessive use of the orders. However, she says that she has decided to examine this matter further.

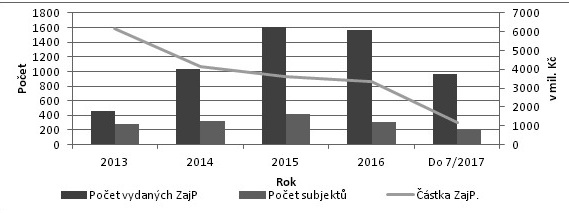

As we can see in the graph below, there has been a significant rise in the amount of orders issued and subjects affected between the years 2014 and 2015. The Financial administration explains this with the formation of the Tax Cobra and a new section of Act no. 235/2004 on value added tax that broadens the range of situations that call for the use of an order to ensure tax. In 201, section § 103 was added to act on value added tax, this section allows for the order to ensure tax to be enforceable from the moment of its issuance if there is a risk of delay. This has been implemented in order to fight tax evasion practices such as the missing trader fraud. The FA is in this case obliged to try and inform the tax subject about the issuance of the order to ensure tax in an appropriate way. Thanks to this provision a possible failure to inform the subject does not change the enforceability of the order. In the case of such failure only one obligation arises for the FA and that is the obligation to write up a record of the attempt to inform the tax subject.

Graph: Amount of orders to ensure tax issued (dark blue), amount of tax subjects which have been affected by the orders (light blue), and the sum of money ensured (grey curve).

Source: The Analysis of Orders to Ensure Tax issued by the Financial administration of the Czech Republic (Analýza zajišťovacích příkazů vydaných Finanční správou ČR), August 31st, 2017

Companies which have brought order to ensure tax connected cases to court have not been very successful so far. Only 7 cases out of 186 have ended with the court agreeing with the suing company. One of the “successful ones” is the VHS-Ropa plus company from Bruntál. The order to ensure tax from this company was issued in 2014 with the reasoning that according to state agents the subject owed the state CZK 10 million of tax. This was followed by a tax distrainment and even though the company now has a legally effective decision about the invalidity of the order, it has not received its assets back yet.

What to say in conclusion?

As the article has mentioned a few times, the Financial administration says that orders to ensure tax are not widely put to excessive use. In singular cases which we read in the media might make it seem the situation is different. And it is these cases that have brought about the critique of the processes of the Financial administration. Because of this critique the administration has promised to change the methodology which should regulate the practice of issuing the orders. Even we have seen cases which make one think whether the financial administration wants to ensure the payment of a rightfully assessed tax or whether it wants to liquidate the tax subject. According to the Tax Code, the financial administration gives the tax payer not only obligations but also a set of rights. The administration shall always abide by the law and if it doesn’t one must defend oneself. In the case of orders to ensure tax this defence must be not only well funded but also immediate. The judicature will surely state – in connection to the cases mentioned above – when and under what circumstances the usage of an order to ensure tax is adequate. We will inform you about any further development of the judicature as well as the development of the administrative practice.