Petra Čechová | 9.4.2024

NI-70 Deferred tax and exchange differences excluded from taxationTaxes, accounting, law and more. All the key news for your business.

Alice Šrámková | April 7, 2017

Do you have more companies, or are you a part of a business group? What is the right time to look at your business as a coat with many pockets?

The law says that every business company (corporation, cooperative) must compile financial statements at the end of its financial year. Some people have their business in one pocket, so to say, meaning that they operate under one company registration number. Some people’s business is more diversified in a way that one company has business shares in other companies (these are the pockets of a coat). And it may be these very companies that consolidation applies to.

Consolidation is a financial model of your business and you can put it together just out of interest, to be able to see your business with a detached view, but it can also be an obligation when others (banks, creditors) want to have the option of a detached view, and they are granted this by the law.

It might just be your company that is newly obliged to compile consolidated financial statements. If that is true and you don’t know about this obligation, you are putting yourself at risk of significant sanctions.

How would you explain consolidation to a layperson?

Those who conduct their business under one company registration number do not need to be concerned. Those whose business is divided for example in five different boxes are required by law to compile financial statements for each of these boxes, that is for each individual company. Those five boxes together, if I was to simplify, are what we call a group. Act on Accounting lays down rules for groups and when a group reaches a certain size, it must compile a financial statement for all the companies together. And that is what we call consolidation.

What is this size a group has to reach?

The size is given by a European Directive. Since 1st January 2016 the size is decided by three numbers: net assets, turnover, and number of employees. The exact figures are: 100 million CZK in net assets, 200 million CZK in turnover, and 50 employees. There is also an important supplement, which is called “on consolidated basis”, which means “after having eliminated all mutual relations”; those are typically mutual claims and liabilities, mutual costs and benefits…

How does a group know it musts consolidate?

A group must consolidate when it surpasses two of these three criteria. It must compile financial statements for consolidated and consolidating accounting entities, that means for the parent company and all its subsidiaries. A subsidiary is the company in which you have a decisive influence; in other words you have more than 50 % of the voting rights. So you take in account the parent company and all its subsidiaries and after you sum together all their net assets, turnovers and employees, you compare it with the numbers mentioned (100 million CZK, 200 million CZK, and 50 employees).

Where have these numbers come from?

The limits are given by a European Directive. Based on the net assets value, turnover, and number of employees the groups are divided into small, medium, and large. A small group, such that does not surpass two of the criteria, is not obliged to consolidate but medium and large groups are.

Until when must groups consolidate?

Individual companies in a group must compile their own financial statements first, and after that compile statements for all the companies together. This must be done until the end of the following financial year. If your financial year corresponds with the calendar year, meaning that you compile financial statements to 31st December 2016, you must compile a consolidated statement until 31st December 2017.

How many companies will be obliged to consolidate this year?

Based on how things have been stirred up, there will probably be many more than before. Many groups that haven’t had this obligation before will have it now because until 31st December 2015 the limits had been 350 million CZK in assets and 700 million CZK in turnover. I think that many companies are not aware of this new obligation yet.

What would you advise these companies?

To not underestimate the most important part – defining your own group. You have to find out which companies you control (which companies are your subsidiaries). If you hold only 30% of shares in a company, as a rule this will not be a subsidiary but only an associate. And because it is not a subsidiary it is not a part of a group and shall not be taken into account when summing up for the limits we have talked about. At the same time, you may have a subsidiary which owns other business shares. In this case you have to find out whether, from the point of view of the subsidiary, you have decisive or major influence in that company. If you do, you must view this company as a part of the group and its assets and turnover must be accounted for in summing up for the limits that decide your obligation for consolidation. Only after defining the group come the figures. There can only be one parent company but there can be an interwoven web of many subsidiaries.

What if a subsidiary has its parent company abroad?

That is not uncommon. In case someone else is compiling consolidated financial statements that you are a part of, then you don’t need to compile it yourself. But the parent company must consolidate according to European law. Which means that if the parent company resides in the U.S. and operates according to American law, you are still obliged to consolidate here in the Czech Republic according to European law.

I can explain that using an example: If you want to buy shares of ČEZ as a parent company which has dozens of subsidiaries here in the Czech Republic and abroad, you are in fact buying shares in all of them; of the parent company and all of its subsidiaries. If you own one share, you basically own one entity of a huge group. And in a case like this you should want to know about the whole group, not just the parent company whose shares you own.

What if someone is obliged to consolidate but they don’t do it?

Then the company puts itself at risk of sanctions for not compiling consolidated financial statements according to Act on Accounting. It’s not exactly a cheap affair, the sum can be up to 3 % of consolidated assets. Administrative offences of first degree are settled by the Financial Administration. For example, if the assets are 500 million, the sanctions could be up to 15 million.

Who can a company or its representative ask for help, if they are not sure whether to consolidate or not?

I would strongly recommend consulting with an expert who has experience with this particular issue.

Does the Fučík & Partners company offer services in this area?

Yes, our offer includes compiling consolidated financial statements, or alternatively expert advice with compiling and audit of consolidated financial statements. The basic rules are explained during our Tutorials; the next one will take place … You can find more on www…

Among both experts and the public there are a lot of misconceptions about when there is need for consolidated financial statements and which companies are subject to it.

There are a few legal terms that need to be explained first.

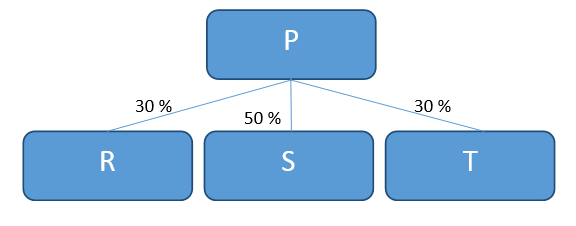

Let us look at a few examples and explain ‘who is who’ and ‘who and why’ must compile the consolidated financial statement. Percentages in all illustrations show the proportion of the voting rights.

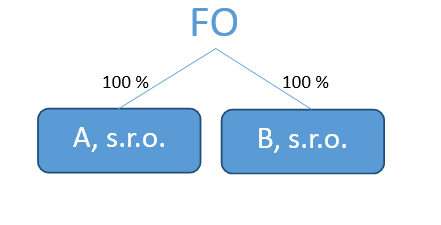

A natural person fully controls two limited liability companies. In this case there isn’t any operating accounting entity (a corporation) and for that reason neither A or B will be consolidated.

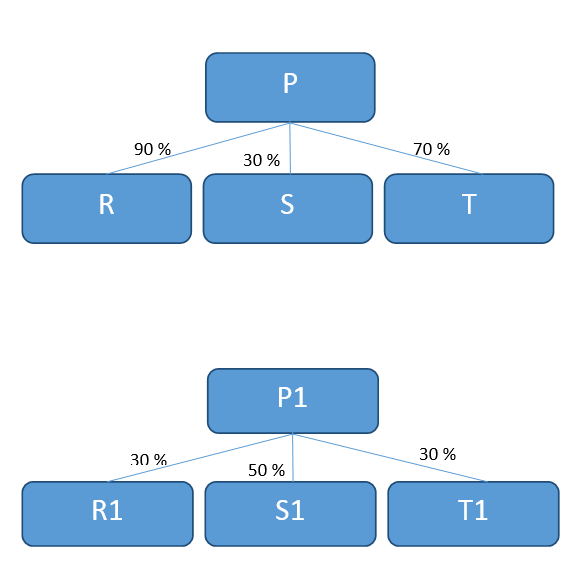

A group consists of companies P, R, and T, which also make up a consolidation entity. Consolidated financial statement must be compiled for that entity. Company S is an associate and the equity method shall be applied to it in compiling the financial statement.

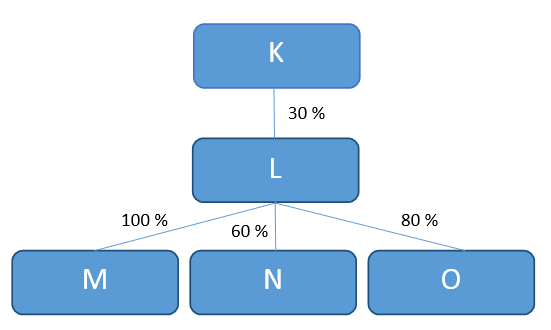

Company O has been purchased with the intention of selling it further.

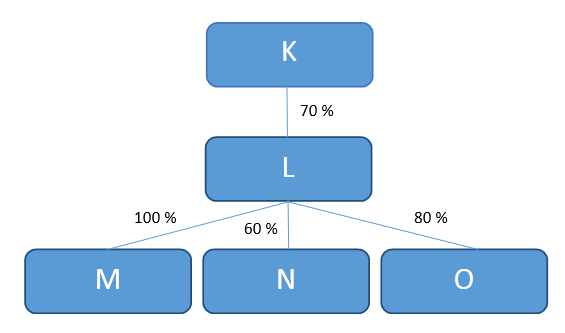

The group consists of companies K, L, M, N, and O. The consolidation entity consists of companies K, L, M, and N. If company K compiles consolidated financial statements according to the law of an EU member state, there is no obligation for company L to compile a partial consolidated financial statement, as long as it is not required by minority shareholders of group L. If company K compiles consolidated financial statements according to the rules of US GAAP for example, group L is obliged to compile the partial consolidated financial statement.

The group consists of companies L, M, N, and O. The consolidation entity consists of companies L, M, N, and O. Company K has no subsidiary and therefore isn’t a part of a group.

Company P has no subsidiaries and therefore no consolidation entity either. Company P will compile only an individual financial statement and in it the shares in companies R, S, and T will be valued by their purchase prices or using the equity method.

Ing. Alice Šrámková

Alice Šrámková is a tax adviser with the Chamber of Tax Advisers of the Czech Republic. She is a member of the National Accounting Council and the Chamber of Certified Accountants.

In the area of accounting consulting she focuses mainly on advising with the use of International Financial Reporting Standards. She also works as an expert accounting consultant focusing on transactions and consolidations.

In the tax area she focuses on corporate income tax.

Together with that she is also a lector and authors articles in publications.