Zuzana Kalincová | 9.4.2024

DAC 6 as an unlawful invasion of privacy? Opinion of the Advocate-GeneralTaxes, accounting, law and more. All the key news for your business.

The obligation to pay income tax in the Czech Republic does not arise only for the citizens of the Czech Republic (Czechia) but also for foreigners who have moved here and work or do their business here. The question is, what income is concerned here. The extent of income taxation depends on one’s tax residence.

Who is a tax resident?

It is necessary to first look at tax residence from the point of view of the local tax legislation. According to the Czech law, one is considered a Czech tax resident if:

a) one has one’s residence in the Czech Republic (permanent residence in the sense of a place where one intends to stay permanently) and/or

b) one usually stays in the territory of the Czech Republic, i.e. one spends at least 183 days per year in the Czech Republic (every commenced day of stay is taken into account).

You could also be considered a tax resident even if you have stayed in the Czech Republic for less than 183 days but had a place of permanent residence here for a part of the year. You are then considered a tax resident only for a part of the taxation period; the time period for which you had permanent residence here according to a).

However, it can happen in practice that a person is considered a tax resident in some other country as well (e.g. the country of which the person is a citizen) based on that country’s national law. If a person is considered a tax resident in more countries, their final tax residence will be decided based on the applicable international convention for the avoidance of double taxation (if such a document exists).

Most of the conventions for the avoidance of double taxation determine the final tax residence based on the following criteria:

a) One is considered a tax resident of the country in which he or she has a permanent residence available. If he or she has a permanent residence available in both countries, he or she should be considered a tax resident of the country in which he or she has stronger personal and economic relations, i.e. where he or she has their “centre of life interests”.

b) if the centre of one’s life interests cannot be determined or if one does not have permanent residence in neither of the countries, one is considered a tax resident in the country where he or she usually spends time.

c) if one usually spends time in both countries or in neither of them, one is considered a resident of the country of which he or she is a national.

d) if one is a national of both countries or of neither of them, the competent authorities must find a solution through mutual agreement.

Here, we would like to point out that determining one’s tax residence is something that needs to be done individually for each person according to a specific international convention, which may differ in some points from the above mentioned.

Range of taxation

Czech tax residents tax their worldwide income (even income from other countries) irrespective of the country of origin of the income. Thus, a Czech tax resident has the obligation to tax for example also passive income which did not originate in the Czech Republic, e.g. dividends paid by a foreign company, interest from a foreign bank account or income from rent of real estate abroad.

Potential double taxation of income of Czech tax residents is prevented in accordance with applicable conventions for the avoidance of double taxation either by a tax offset of the foreign tax or by exclusion of foreign income from taxation. If there is no convention for the avoidance of double taxation in a specific case, the tax paid abroad can be, under certain circumstances, applied as tax expenditure here.

On the other hand, tax responsibility of tax non-residents is limited to only income originating in the Czech Republic, e.g. from employment in the Czech Republic or income of board members of a Czech company. What we understand by “income originating in the Czech Republic” is decided differently based on the type of income. Income of a Czech tax non-resident will most likely be subject to tax in the country where this taxpayer is a tax resident. In order to avoid potential double taxation, the country of that person’s tax residence will adhere to an applicable convention for the avoidance of double taxation, if available.

Taxation of income from rent

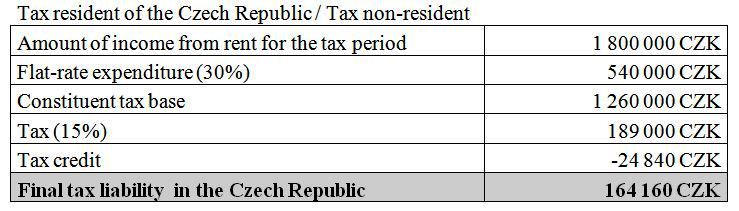

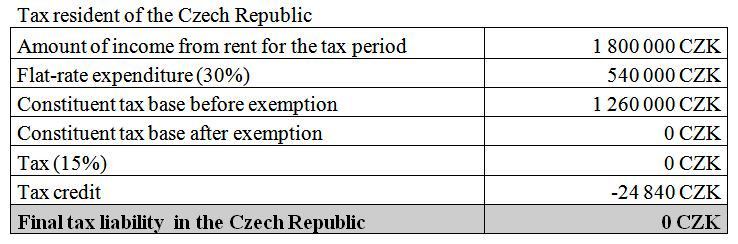

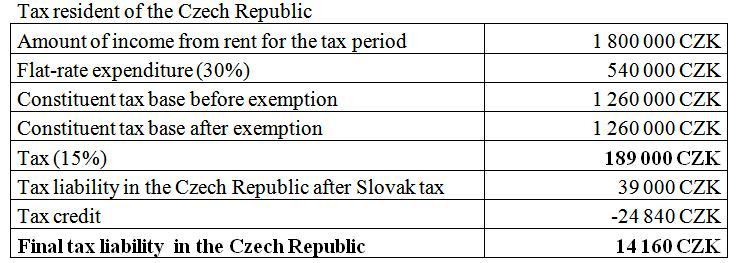

With the following (simplified) examples, we would like to illustrate the different taxations of income from rent of immovable property in the Czech Republic, Germany, and Slovakia. In all of these examples, the tax payer’s only income is the income from rent on the amount of CZK 1 800 000 and flat-rate expenditure is applied in the amount of 30% of the income. The only tax credit taken into account is the tax credit per taxpayer of CZK 24 840.

1. The only income of the taxpayer that is subject to the tax on income of natural persons for the year 2017 is income from rent of a housing unit in the Czech Republic:

2. The only income of the tax resident that is subject to the tax on income of natural persons for the year 2017 is income from rent of a housing unit in Germany. In accordance with the appropriate convention for the avoidance of double taxation the income of a Czech tax resident from rent of immovable property located in Germany will be taxed in Germany. A Czech tax resident has the obligation to state this income in the tax return form submitted in the Czech Republic where this income, according to provisions of the convention, can be exempt from taxation.

Tax non-residents of the Czech Republic do not state this income in their tax return form because income from rent of immovable property located in Germany does not originate in the Czech Republic.

3. The only income of a tax resident that is subject to tax on income of natural persons for the 2017 tax period is income from rent of a housing unit located in Slovakia. In accordance with the applicable convention for the avoidance of double taxation, income of a Czech tax resident from rent of immovable property located in Slovakia will be taxed in Slovakia. In Slovakia, the tax paid from this income was 150 000 CZK (this amount is only an example and does not reflect the reality of tax liability specified by Slovak legislation). In accordance with the applicable convention for avoidance of double taxation, the income tax paid from income of a Czech tax resident from rent of immovable property located in Slovakia will be deducted from the tax liability in the Czech Republic.

Tax non-residents of the Czech Republic do not state this income in their tax return form because income from rent of immovable property located in Slovakia does not originate in the Czech Republic.

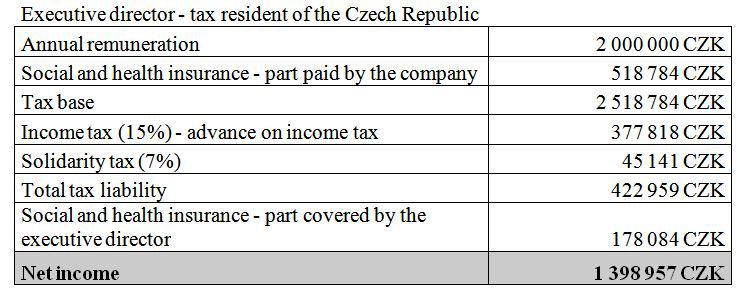

Taxation of members of statutory bodies

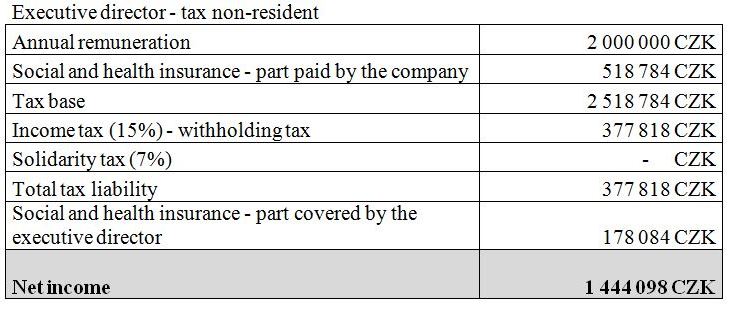

Interestingly, taxation of members of statutory bodies of Czech companies (e.g. chairman of the board, executive director) can also differ. The tax residence is decisive in these cases already for the monthly tax payments of the company. Tax residents are taxed similarly to employees, i.e. their remuneration is subject to advance payments of income tax from employment. However, the income of members of statutory bodies who are tax non-residents is subject to withholding tax. Below is a simplified calculation for 2017 to illustrate:

Note: No tax credit was taken into account in these calculations. This calculation also does not take into account a case where the executive director takes part in a foreign health and social insurance system.

In the given situation, the executive director who is a tax resident would have the obligation to submit a tax return form on income tax of natural persons for the year 2017 because the income exceeded the limit for solidarity tax. He or she could apply tax credit per taxpayer in the tax return, or other credits or discounts based on which conditions would be met. The non-resident executive director does not have this obligation because the paid withholding tax is considered final (if he or she has not received any other income taxable in the Czech Republic). However, the non-resident executive director can decide, under certain circumstances, to submit a tax return. In such case, he or she could apply the tax credit per tax payer, or other credits or discounts based on which conditions would be met. But in this case the income would be subject to solidarity tax. The situation of members of statutory bodies who are tax non-residents must always be handled individually in order to find the most beneficial variant.

In case you are interested in more concerning this topic or would like a consult about a situation similar to those suggested above, do not hesitate to contact us.