Petra Čechová | 9.4.2024

NI-70 Deferred tax and exchange differences excluded from taxationTaxes, accounting, law and more. All the key news for your business.

Michal Kováč | July 16, 2021

Every company tries to find the best way to accommodate the conditions of its customers and at the same time to ensure payment of its receivables. Below we will describe how factoring could help us with this issue.

What is factoring

Factoring belongs among alternative tools of short-term financing. The principle of factoring is based on contractually agreed purchase of short-term receivables, mostly before their maturity, by a factoring company.

In principle, the supplier sends invoices to his customer and the factoring company (factor), which usually finances 80 to 90% of the value of the assigned receivable (depending on the creditworthiness of the customer). A factoring company deals with financing of current receivables and actively looks after recovery and collection of assigned receivables. In case of non-recourse factoring (see below for further details), a factoring company may also take over risks related to customers’ insolvency.

Statutory stipulations that govern factoring

There is currently no definition, no special legal treatment specifying the issue of factoring. It is a contractual relation, based on a so-called innominate contract.

We may partly work on the basis of the Civil Code (act no. 89/2012 Coll.), where assignment of receivables is governed and general stipulations on liabilities are defined.

For accounting, the Accounting Act (no. 563/1991 Coll.) applies, decree no. 500/2002 Coll. for entrepreneurs (or 501/2002 Coll. for banks) and the Czech Accounting Standards.

We may find some support in Interpretation I-12 Factoring, issued by the National Accounting Board, where accounting of the individual forms of factoring is discussed.

Decrees and regulations for banking/financial institutions – regulating mediators of asset financing, for example decree no. 314/2013 Coll. – also deal with the issue of factoring.

For whom is factoring suitable

Factoring is an ideal product for companies with regular and repeated supplies to customers, where their products or services have fast circulation. It is important to mention that factoring significantly reduces the risk of non-payment by the customer and improves cashflow, and therefore for companies, which have a problem with their customers’ payment, this may ensure the necessary financial sources.

On the other hand, factoring is generally not recommended for custom production and construction.

There are multiple types of factoring. Below, the most frequently use type of this financing method, domestic factoring, is described.

Domestic factoring focuses on purchase of receivables arising between a Czech customer and supplier. We can divide it into recourse and non-recourse factoring.

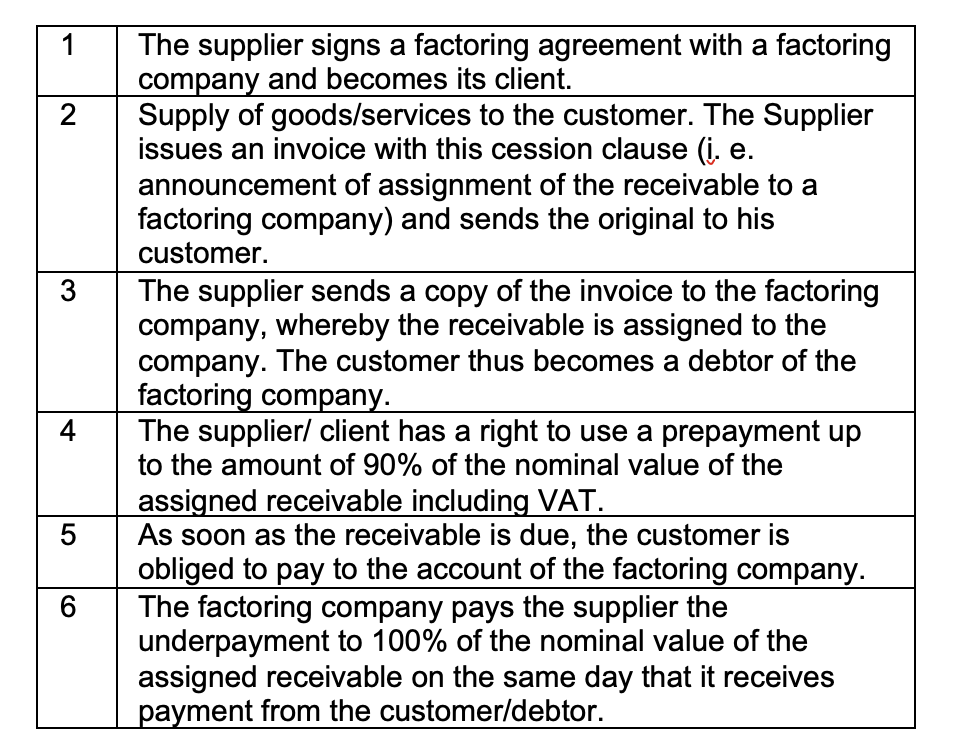

1) Recourse factoring – frequently called not true factoring, represents a service, where the factor does not take over the risk of insolvency of the customer and this risk remains on the side of the supplier. In the factoring agreement, there is a stipulation on assignment of a receivable for a definite period of time, which contains a so-called recourse period. It is a factoring time, when the factoring company performs all moves needed to collect the receivable. In recourse factoring, the receivable remains a possession of the supplier, and it should therefore only be subject to on-balance-sheet recording, i.e. we should separate factoring invoices to a special analytical account in the accounting.

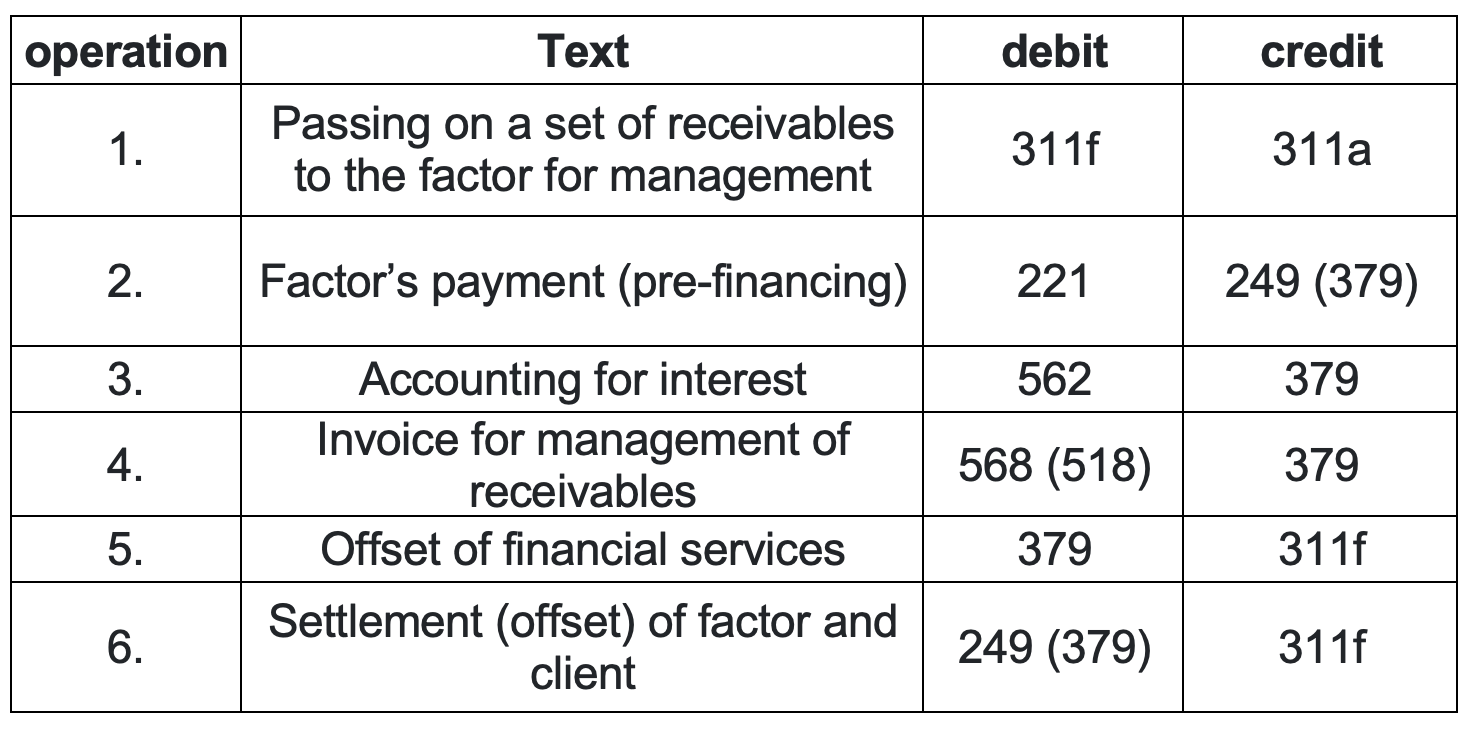

2) Non-recourse factoring – differs from the first case in that the factor takes over rights and risks upon assignment of receivables, and the price of this service is higher than in the case of recourse factoring. With regard to the fact that in non-recourse factoring, possession of the receivable is passed on from the supplier to the factor, we should, according to the applicable accounting regulations, in this case always enter it in profit/loss, because this is an assignment of receivable.

Representation of the process of non-recourse factoring, i.e. assignment of receivables

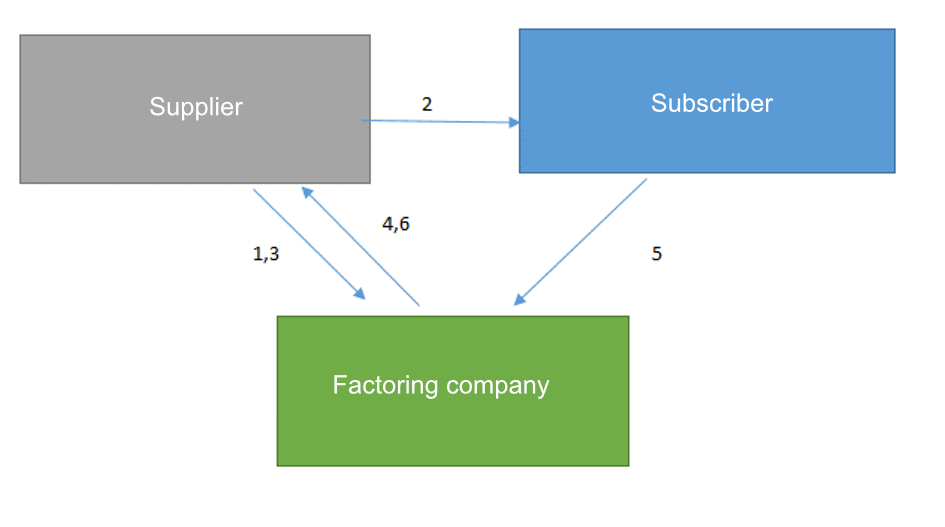

In general, we may say that the process of assignment of receivables is divided into two stages – the contractual stage, when contractual conditions are negotiated, and the stage of realisation, which represents the process of provision of finance itself. Factoring is a contractually-based transaction, in which 3 entities enter in total – the supplier of goods/services, the customer and the factor, who buys receivables. Their mutual relations are show in the following chart.

(supplier – customer – factoring company)

Source: KAČR (Chamber of Auditors of the Czech Republic)

Supplier accounting for factoring

As has been mentioned, in case of possession of the receivable is not transferred (recourse factoring), it should only be subject to on-balance-sheet recording.

In case of transfer of ownership (non-recourse factoring), we should enter it into profit/loss.

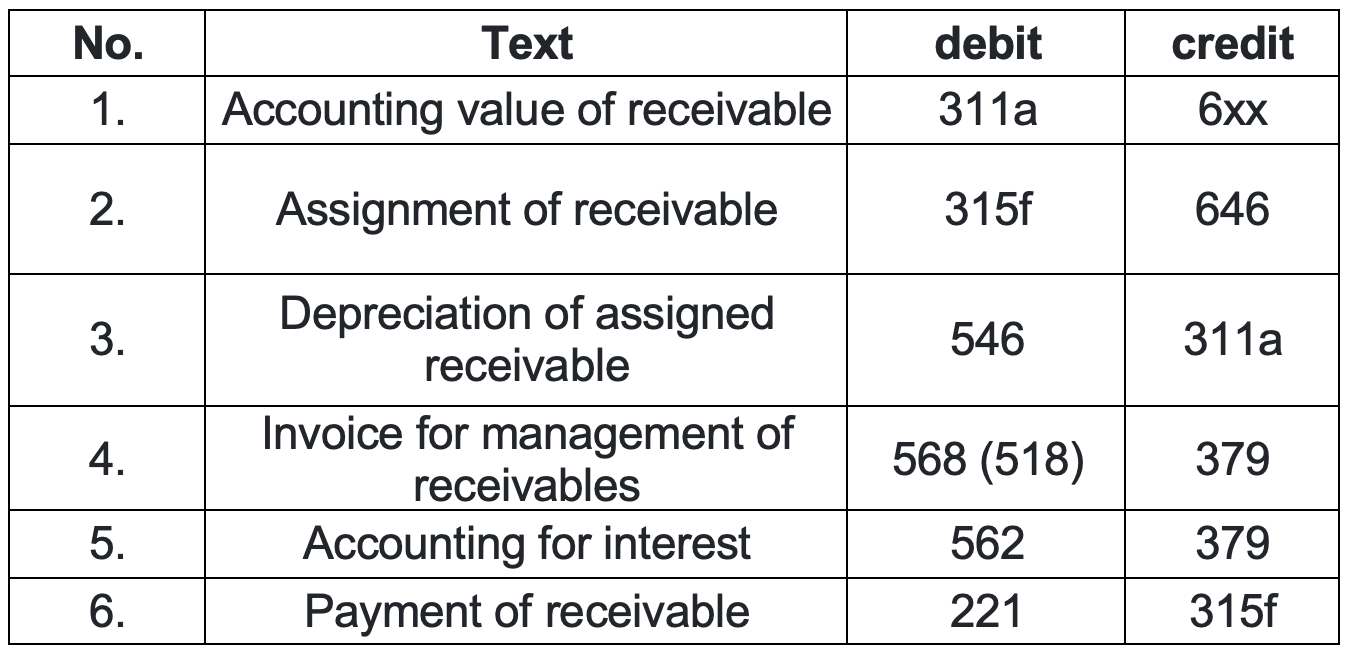

*Account names:

221 – bank accounts

249 – other current financial assistance

311 – customers

315 – other receivables

379 – other payables

518 – other services

546 – depreciation of receivable

562 – interests

568 – other financial costs

646 – revenues from depreciated receivables

Price of factoring

Most factors charge two costs of services, interests and a factoring fee, but it is also possible to encounter a fee for taking over the risks of failure to pay.

The interest is calculated from the drawn-down volume of financing. Interest rates are usually on the level of a common interest rate for overdraft (loan) facilities, linked to the interbank lending market interest rates.

The factoring fee is connected to the costs of services and to administration of the management of receivables, it is charged for example for keeping the balance account or for reminding the customer etc. The amount of the factoring fee usually derives from the amount of turnover.

The fee for risk of non-payment is only charged in case the factor takes over the risk of non-payment on the part of the customer. The amount of the fee is then determined from the nominal value of assigned receivables.

Advantages and disadvantages of factoring or what can you base your decision on

One of the great advantages of factoring is that the supplier does not need to wait for payment from the customer and has the money immediately available and may use it for payment of payables or for his other transactions. It is especially advantageous, if supplies have a longer period of maturity and the supplier needs financial sources sooner than at the time of maturity.

Factoring companies also look after reminding about receivables, collection and the total management, so administration costs are reduced. If we summarise it all, the main advantages of factoring are:

On the other hand, the costs of factoring services are usually higher than in the case of financial sources obtained for example by means of a loan. Factoring companies also verify the creditworthiness of the customers, i.e. if the customer is not creditworthy, the factoring company will not want to finance the customer.

Among the main disadvantages we may thus include:

What to say to conclude….

The issue of financing is one of the fundamental questions in managing a company. Factoring is one of the options for short-term financing without indebtment. This one-time tool helps with financing a company and it is widely used because of the complexity of services, cashflow optimizing and relatively easy accessibility.

Are you currently discussing the possibility of introducing this type of financing at your company and you are not sure, if and how to reflect this fact in the accounting, or do you need to select the right type of factoring? Please, turn to us, we will be happy to assist you in this area.