Petra Čechová | 9.4.2024

NI-70 Deferred tax and exchange differences excluded from taxationTaxes, accounting, law and more. All the key news for your business.

The global (Covid-19) pandemic has significantly influenced the operation of global trade as well as the local economy. There are many aspects companies take into account when planning the operation of their business, but they did not previously need to deal with many risks brought by the pandemic and attributed only low or no weight to them. The certain degree of uncertainty is gradually being reflected in the planning of entrepreneurs.

One of the areas of business that has been significantly affected by the pandemic is the logistic. In the course of the year 2020, delays occurred in the supply of inventory – both the material needed for production and finished products intended for sale. Problems with production and satisfying clients’ demand then related to these problems. Entrepreneurs have tried to find an answer for moderating the risks in the logistic chain resulting from uncertainties brought by the global pandemic in applying various approaches to inventory management, too.

In this article, we are trying to familiarise the reader with the current situation on the market as well as suggest some options for addressing the risks and preventing problems arising from disturbance of the supplier chain and insufficient inventory for satisfying the demand.

We can describe the situation well using the problems automotive producers encounter at the time being. In the course of the year 2020, the supply of some key components was interrupted, which deepened a number of previous problems for automotive producers. At the time when demand for vehicles increased abruptly in Q4/2020, due to optimistic expectations of the buyers, the automotive sector encountered a shortage of supplies. This was mainly due to the outage of supplies of semiconductor components[1] that are used for the production of modern cars. Producers were unable to satisfy demand to such an extent that they gradually had to stop production, leaving it in the state of unfinished production for a longer period of time.

Therefore, the year 2021 began with a “semiconductor crisis” for large automotive producers. European giants such as Mercedes – Benz, Audi, Porsche or VW, same as other global producers, gradually began to suspend production of some car models due to shortage of inventory, and even closed down some plants completely. The crisis subsequently forced automotive producers to reconsider the inventory planning method, from the just-in-time methods (see the inventory management methods further in the text), which is the established standard among car producers, and to start accumulating stock of high-circulation material and goods.

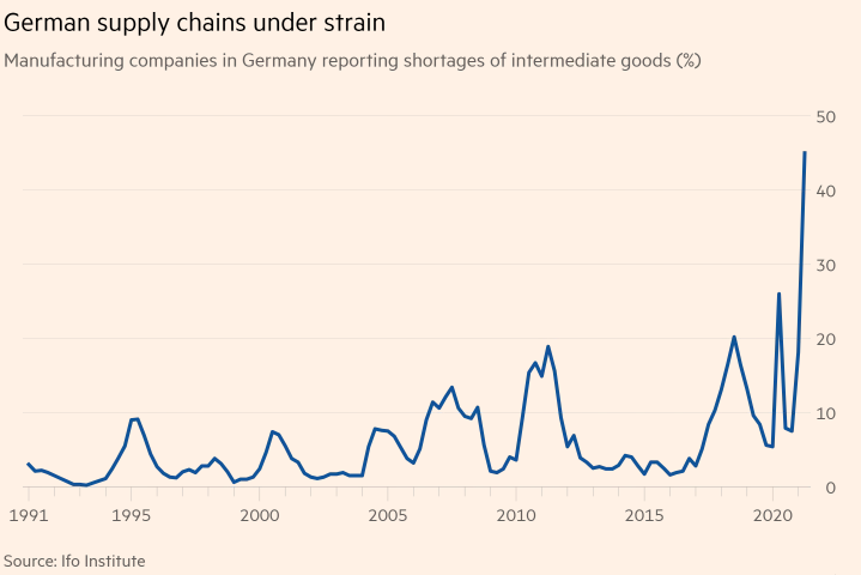

The pandemic has revealed a number of shortcomings and strengthened the endeavours for effective inventory management. According to current surveys[2], approximately one half of the responding German producers speak about disturbance of the supplier chain in the past months. To a somewhat lesser degree, they point out top level of capacity use, while struggling with 45 % production suspension on the level of semi-finished product or in the stage of unfinished production. When automotive producers began to halt production lines, supplies slowed down and costs increased, immense pressure on global supplier chains was created.

How can this problem, which emerged due to the crisis of the year 2020 be solved? Let us first take a look at the options for stock management.

How is it possible to tell, if a company manages inventory well? The key indicators for quality inventory management are the so-called service level[3], stock circulation, stockout amount[4], value of held inventory etc. Let us also discuss the basic types of inventory some more:

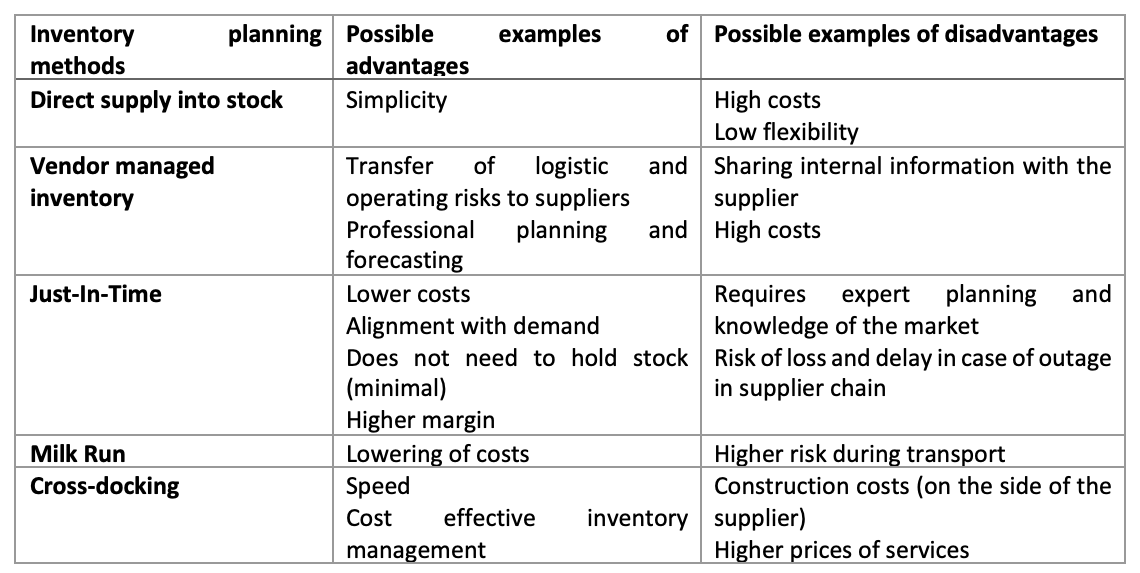

When managing inventory, a company should consider, in what way it will arrange supply of material/goods to its warehouse. There is a wide range of options for arranging supplies. The basic inventory planning methods include the following ones, for example:

Direct supply into stock: Suppliers bring supplies to purchasers (usually using a contract with a transporter) directly into their warehouse.

Vendor managed inventory: The purchaser practically does not look after the inventory – the supplier checks the amount and the orders. The supplier may, but need not own the goods and he is in charge of checking inventory and determining the minimum safety stock (we transfer forecasts, planning and generating of orders to the supplier) – this involves an adjustment of software, so that the supplier could see the current inventory.

Just-In-Time consists in lowering the large volume of inventory in stock, with components being supplied just before production with the given components takes place, in the quality and with the documentation required. The method also contributes to lowering costs due to lower consumption or lowering costs due to lower need for storage space and it also prevents accumulation of unsold finished products. Daily supplies help maintain stable financial balance. This system enables frequent presentation of offers by subcontractors (for example suppliers of components), which, as a result, means the option of higher margin or lowering of process for the producers of final products and their own price wars for market share. A modification of the JIT method is, for example, the just-in-sequence method (for complex products) or kanban (based on the push&pull principle).

Milk Run: This concept is based on replacing direct supplies from several suppliers with one consolidated consignment, which is often realised using one means of transport. The aim is greater use of transport capacity and thereby the achievement of lower transport costs and ensuring of standardization and regularity in supplies.

Cross – docking: The concept of cross-docking consists in directing material flow between a certain number of suppliers and purchasers for the purpose of achieving low transport costs with high frequency of supplies. The aim is to supply the classic direct supplies between suppliers and purchasers by bringing the goods into one centre, from which they are subsequently dispatched without storage and while maintaining high occupancy of means of transport with a high frequency of supplies.

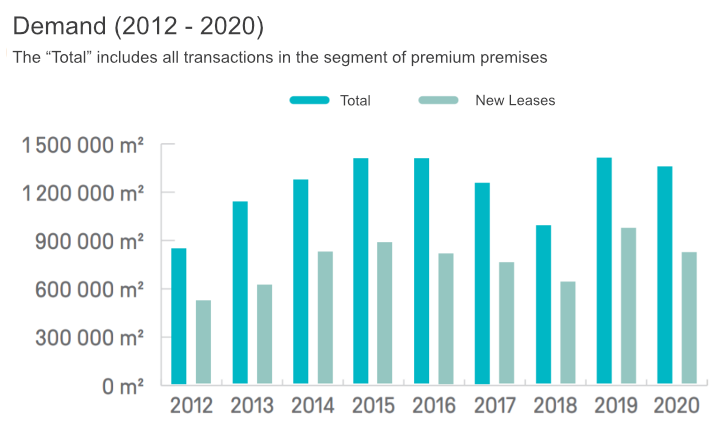

An important question when deciding, how a company will manage its inventory, especially in the time of the current pandemic crisis, are the current options and prices of storage spaces. Given the current occupancy, the trend of increase in storage space prices can be expected to grow further, as confirmed in the 4th quarter of 2020.

Despite extensive construction of new storage premises especially in the Moravia-Silesia region in the final quarter of 2020, the vacancy rate in storage premises currently reaches only 4.94%. This is while the total area of logistic industrial premises to let reached more than 9 million m2 at the end of the year 2020. If the planned projects are included, the total area has a potential of reaching 14 mil. m2 in future.

The situation in Prague and the surrounding area has remained nearly unchanged. The continuing low vacancy rate and the limited number of planned projects cannot currently satisfy the future demand given by the growth potential of the region. But the continuing growth of e-commerce (which experienced its boom in the course of the year 2020 and at the beginning of 2021), might stimulate greater cooperation between companies, regional authorities and other government institutions for the purpose of creating new opportunities for industrial development in this region.

THE TOP 5 REGIONS ACCORDING TO THEIR TOTAL STORAGE SPACE AREA[5]

According to the above, there is a shortage of storage premises on the market and tenants find new premises quickly. The average vacancy rate in the year 2020 reached a mere 5.20 %. This trend is no doubt due to the Covid-19 pandemic, due to which demand for storage premises has increased, mainly because of the government measures and the related robust increase in online commerce.

The markets have partially been affected by the companies’ inability to correctly adjust expectations and forecasts, which producers often caused by inexpert approach and overstocking for fear of lack of inventory, thereby also creating its partial deficit. How to manage inventory as effectively as possible in the current times, then? From the perspective of effectivity of stock, it is theoretically still suitable to choose the JIS (Just In Sequence) method in case of producers or JIT in case of sellers.

In the automotive industry, despite the highest prices of copper and steel in the past 10 years, interruption of supply chains and shortage of rubber for the production of tyres and other automotive components, some automotive producers are still unwilling to change the current JIT system, undergo risk of outage but avoid creation of inventory, the holding of which costs money.

The JIT methods has shown its qualities, if set up well, for example for BMW, which, unlike other producers mentioned earlier, did not register interruption of operation related to outage of supplies and insufficient stock. The same applies to Valeo, one of the world’s largest suppliers of automotive components.

Companies, which fear uncertainties in the prediction of future development, should carry out planning in an agile way only for several months ahead, determining partial goals, which would help them achieve their aims on the go and react dynamically and flexibly to the fluctuations of the market. This, however, also requires flexibility of providers of logistic services and promotes outsourcing the logistic, and thus the Vendor-Managed Inventory, when the supplier will take over a part of the risks and planning. Companies can focus more on the main area of their business activity and do not need to deal with issues related to rental and operation of warehouse halls, staff or IT solutions of inventory management.

Despite the original expectation that the market would stabilise in the course of the second quarter of 2021, everything suggests that the delays and interruption of production and problems in supplier chains will continue until the end of the year at least. Supplier chains are mainly disturbed within the automotive market. This has been shown by the producers’ insufficient ability to satisfy demand, led by renewal of global trade from China. The deepening semiconductor crisis is thus beginning to spill over to the markets of electronics production, which may soon encounter the same problems with delays in production.

What can a company do to at least partially reduce the risks arising from the current uncertainties in the supplier chain:

When selecting the type of inventory management, producers need to consider, which will be the most suitable for their type of production, experience, aversion to risk or according to the expected costs they are willing to expend on services related to planning and holding inventory. If less-experienced companies use this risk-strewn period and hire experienced planning professionals, perhaps even for short-term cooperation, they may thus train their own generation of planning managers. Or they can use this difficult period as a platform for long-term cooperation with partners they can rely on.

Which method to use and what effect will this change have on your financial results, planning or accounting? And why is that particular method the most suitable for you?

You can find this out from our experts on the management of corporate finance and planning. Every company is unique and so it our approach, which is tailored for our clients.

[1] Semiconductor components are mainly used in the production of electronics, among other things computers, consoles and smartphones, the demand for which has increased during the pandemic. This sector is, moreover, also influenced by the cryptocurrency trend, in which modern computers are used.

[2] Source: Ifo Institute

[3] The probability, with which we will have inventory in stock on time

[4] Shortage of inventory in stock

[5] Source: 108agency